Funding

To diversify its sources of financing and better manage cash flow while reducing the impact of payment delays, Diot-Siaci Crédit offers innovative financing solutions tailored to your company’s needs.

find all our latest news on

DIOT SIACI Finance supports its clients in selecting, negotiating, implementing, overseeing, and optimizing their domestic and international financing.

When the most suitable financing options for your company are not offered by traditional banking sources and as corporate financing evolves with new players emerging, we aim to be the “financing reference” for our clients.

We intermediate and structure financing, overseeing its implementation with selected financiers and experts (auditors, lawyers, trustees, third-party holders) through partnerships.

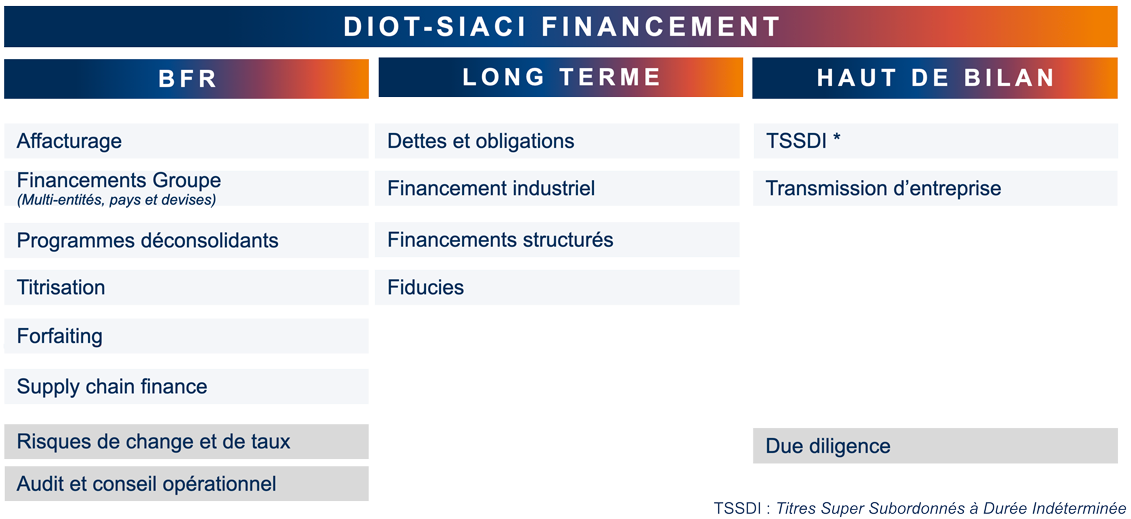

Our strategy rests on three pillars

How do we approach our profession?

DIOT-SIACI Finance guides you through the selection, negotiation, implementation, oversight, and optimization of your financing solutions. Following a diagnostic and validation of a technical and commercial proposal, DIOT-SIACI Finance:

- Structures financing arrangements.

- Assists in implementation with financiers and service providers (auditors, lawyers, trustees, third-party holders) selected through partnerships.