DIOT SIACI FINANCEMENT supports its clients in the selection, negotiation, implementation, management and optimization of their domestic and international financing.

When the most appropriate financing for your business is not offered by the banking sector and when business financing is recomposed with the emergence of new players: we have the ambition to be the “financing referent” for our customers .

- Intermediate and structure financing

- Supervises its implementation with financiers and experts (auditors, lawyers, trustees, third-party holders) selected within the framework of partnerships.

A strategy based on 3 pillars

Structuring and arranging transactions

Even design tailor-made financing, in the service of the financing strategy defined with you.

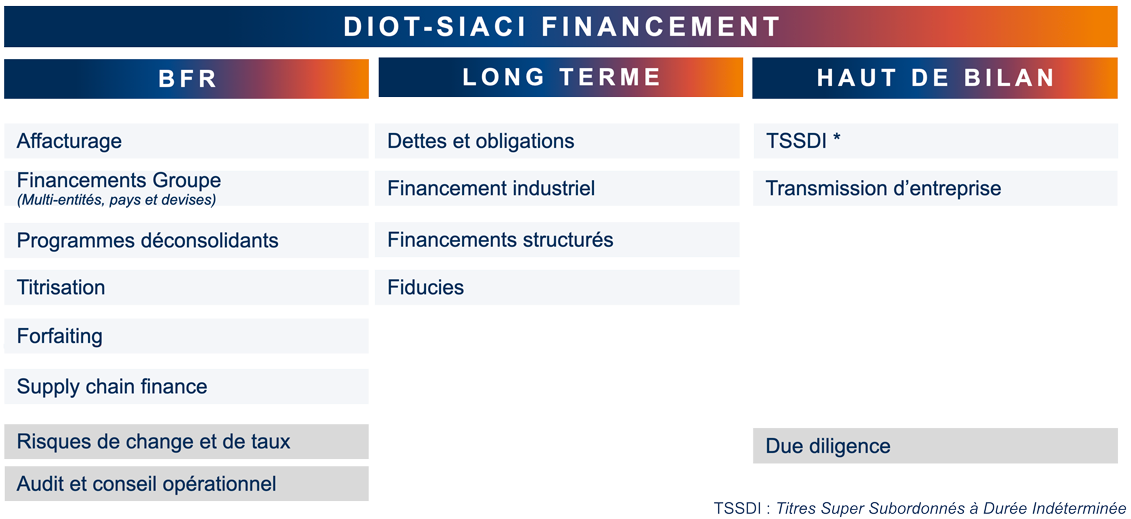

Get out of the BFR prism

Open the offer to other financing (financing of assets of all kinds, bond debt and quasi-equity, fiduciary arrangements, complex working capital financing programs, etc.)

Operate in an ecosystem

Diot-Siaci Crédit, lawyers, auditors, chartered accountants, trustees, financiers, all work to offer a comprehensive service combining complementary expertise.

How do we think our profession?

DIOT-SIACI Financement supports you in the selection, negotiation, implementation, management and optimization of your financing.

After diagnosis and validation of a technical and commercial proposal, DIOT-SIACI Financement:

- Structure the financing

- Accompanies its implementation with funders and service providers (auditors, lawyers, trustees, third-party holders) selected within the framework of partnerships.

What is the cycle of your future funding?

Analyze and Optimize

Analysis of financial balances

Complete audit of financing needs

Inventory and analysis of existing funding

Understanding of the issues from a situational and prospective perspective

Deliverables : recommendations for additional and/or substitution funding and/or optimization of existing funding.

Goals :build a financing strategy adapted to the situation and objectives of your company.

Support in the decision

Deliverables: selection of operators, validation of offers in their technical and operational components, negotiation, recommendations, verification of legal documentation.

Goals: obtain the financing adapted to your company: sustainability, operational simplicity, economic performance.

Implement and pilot

Deliverables: implementation, training, procedures.

Goals: manage and steer financing, ensure mutual compliance with contractual commitments, check compliance of costs and outstanding amounts financed.

Our other domains